| CHAPTER | 18 |

| Forbes Bookeeping | |

|

|

18.1.1 Overview

|

|

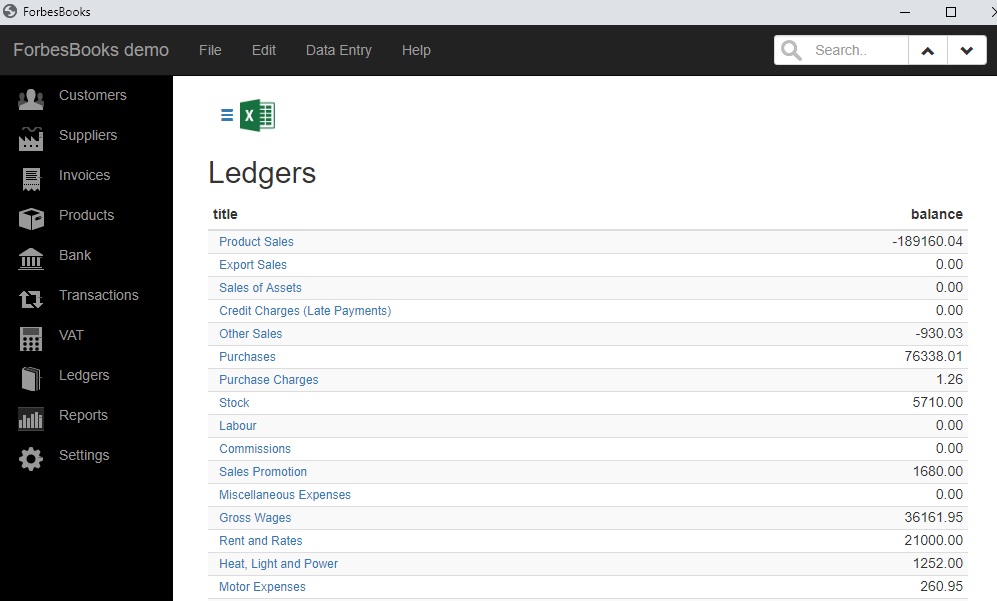

18.1.2 The modules

The modules pane down the left hand side lists the modules

|

|

18.1.3 The common transaction types

Transactions can be entered via the transactions window or as listed below

18.1.4 Less common transaction types

Transactions can be entered via the transactions window or as listed below

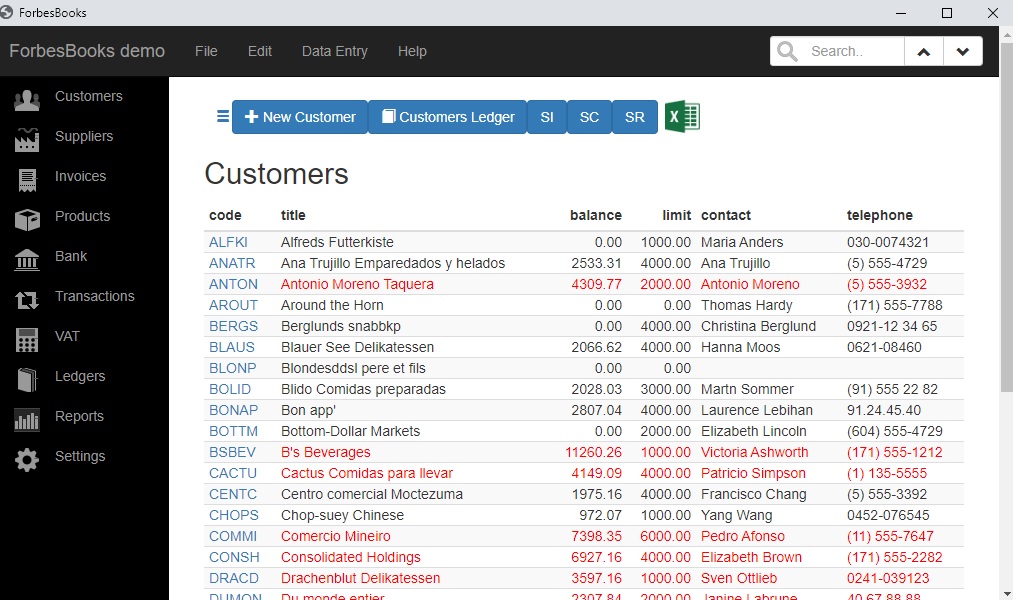

Click on the Customers module.

|

18.2.1 New Customer

Creates a new customer.

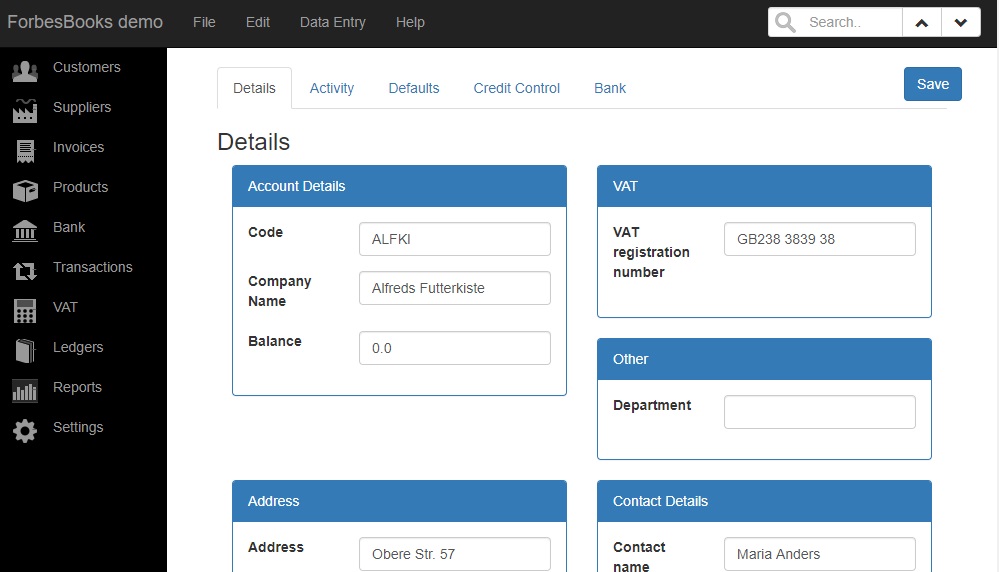

18.2.2 View or Edit

Click on the customer code to view or edit the customer record

|

18.2.3 Customers Ledger

View all customer transactions

18.2.4 Create Transactions

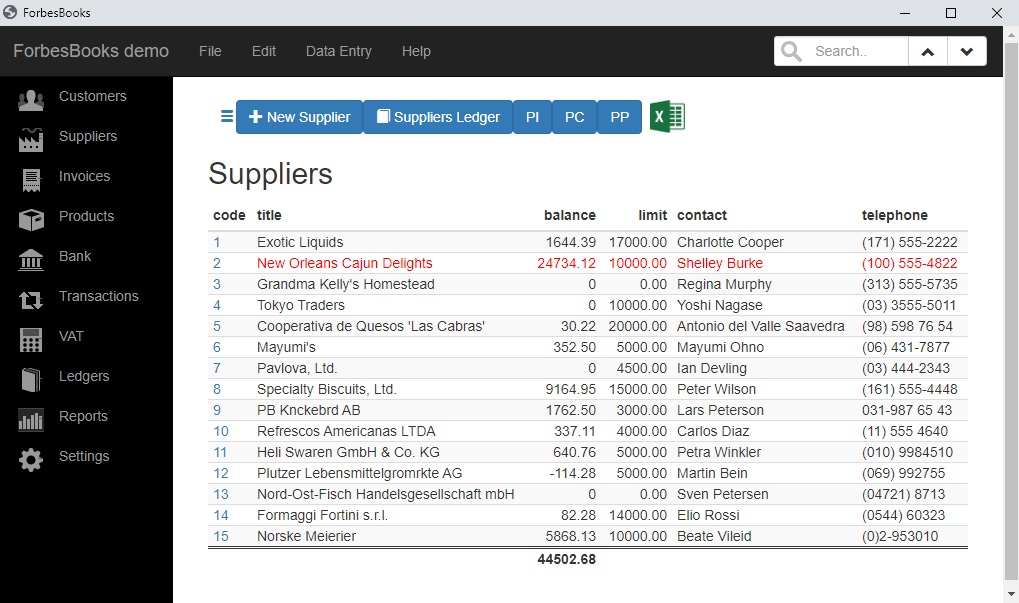

Click on the Suppliers module.

|

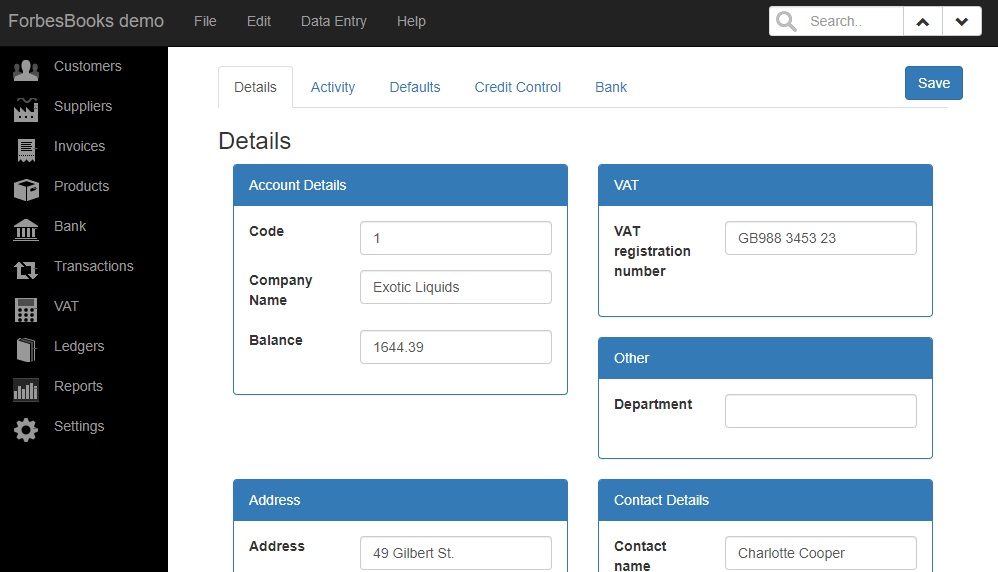

18.3.1 New Supplier

Create a new supplier.

18.3.2 View or Edit

Click on the supplier code to view or edit the supplier record

|

18.3.3 Suppliers Ledger

View all supplier transactions

18.3.4 Create Transactions

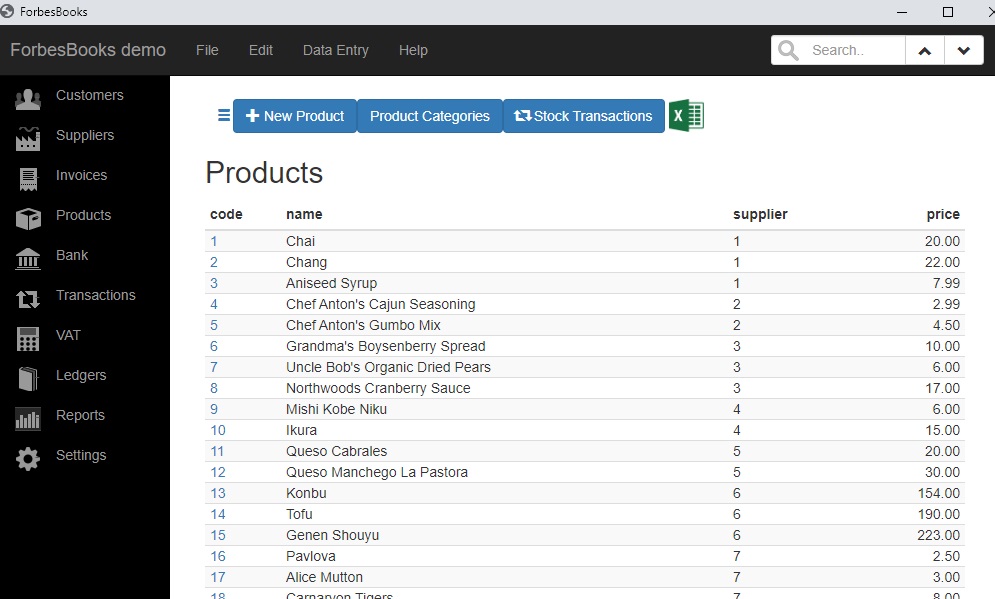

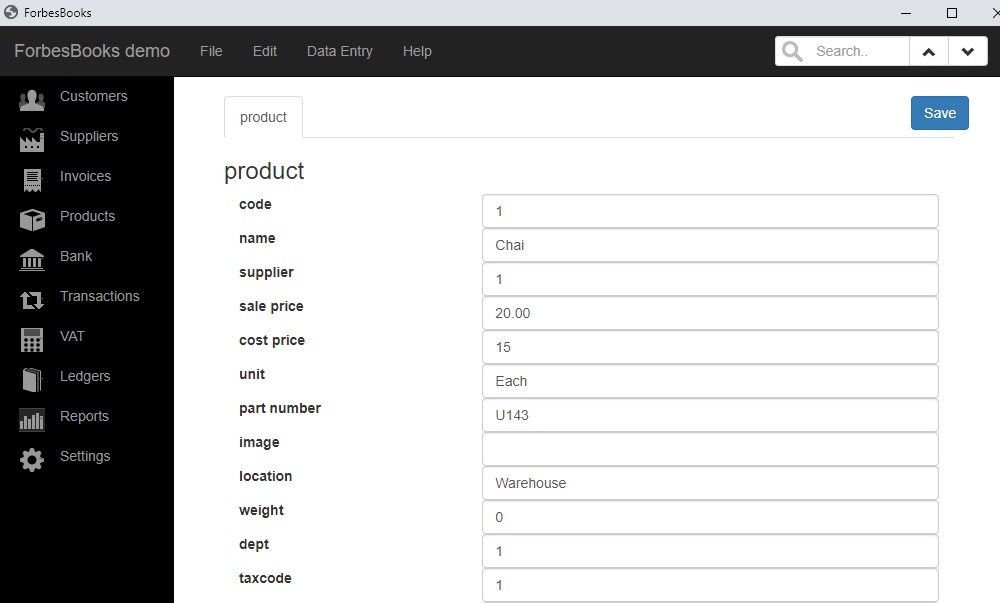

Click on the Products module. Product codes and prices are used for generating invoices for products and services.

|

18.4.1 New Product

Create a new product.

18.4.2 View or Edit

Click on the product code to view or edit the product record

|

18.4.3 Product Categories

Products can be grouped into categories. Set up the categories here.

18.4.4 Stock transactions

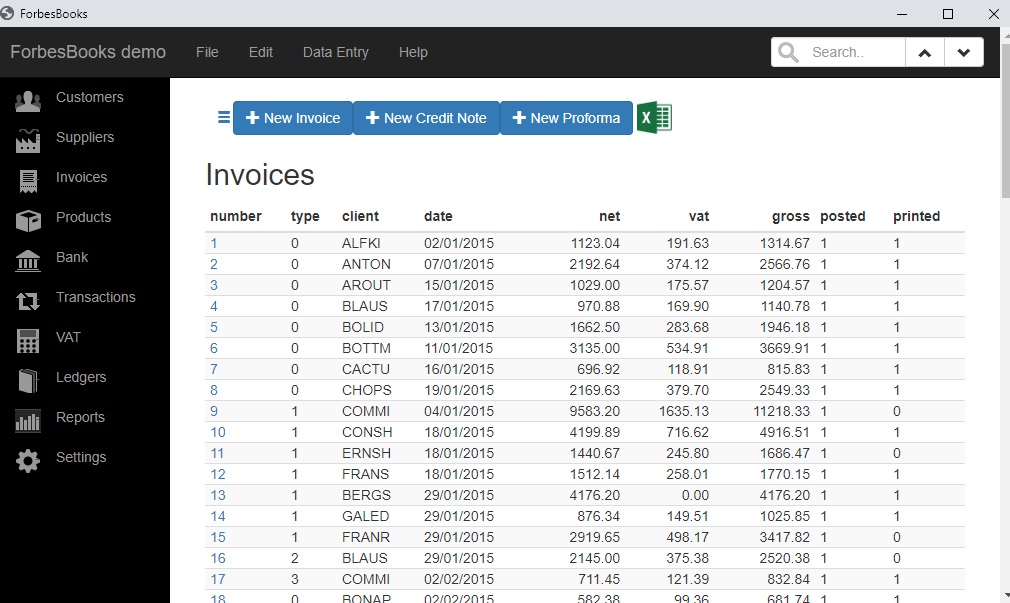

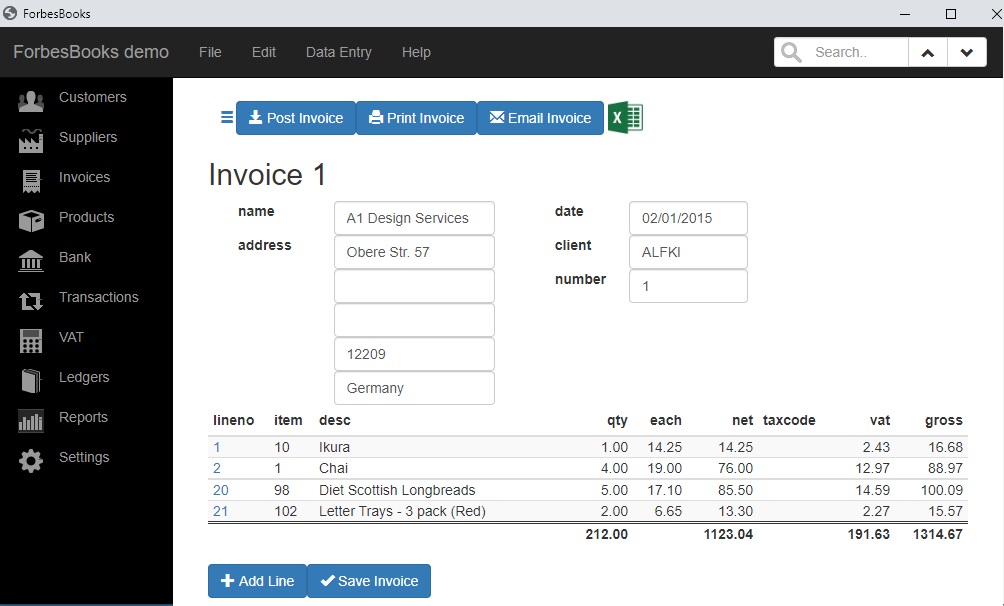

Click on the Invoices module.

|

18.5.1 New Invoice

Create a new invoice.

18.5.2 View or Edit

Click on the invoice number to view or edit the invoice record

|

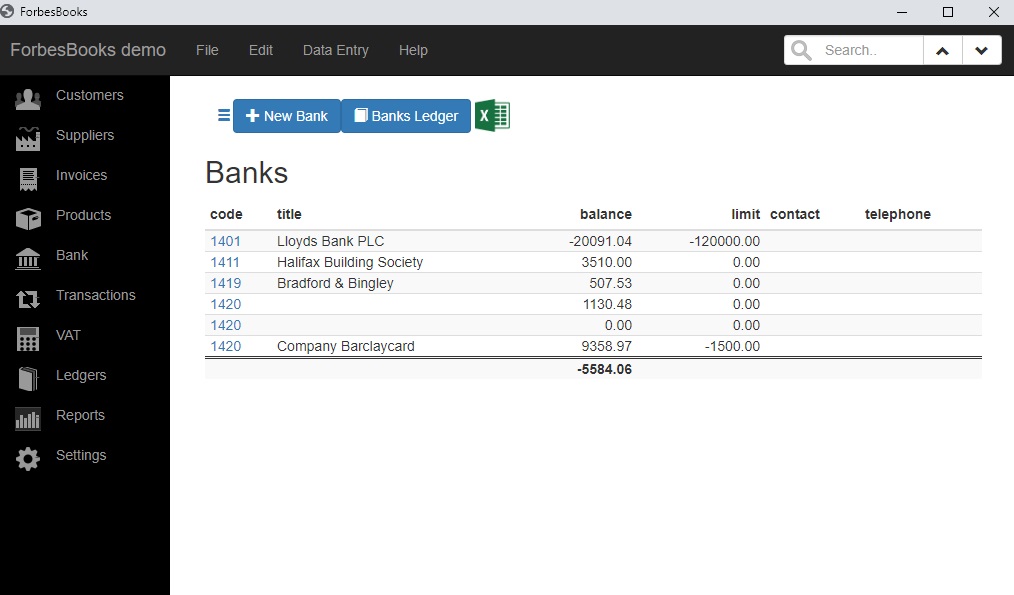

Click on the Banks module.

|

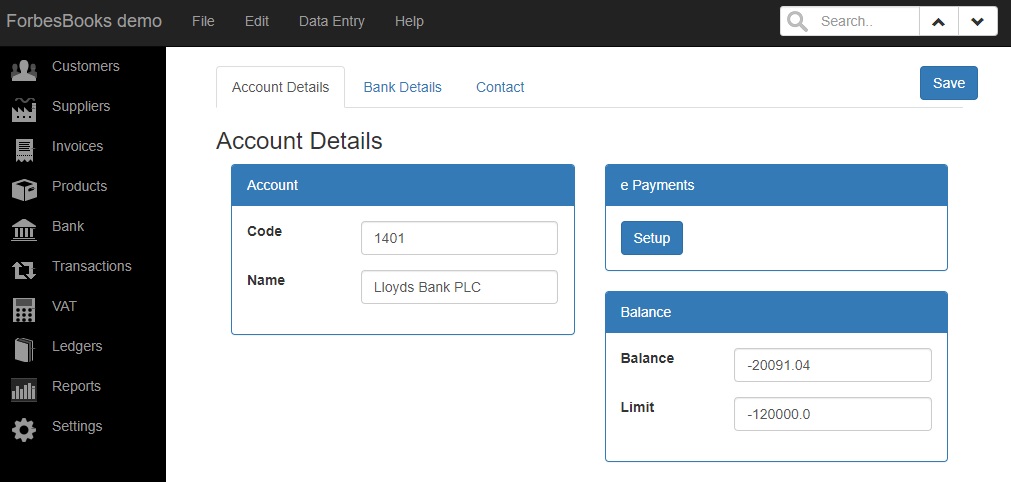

18.6.1 New Bank

Create a new bank account

18.6.2 View or Edit

Click on the bank code to view or edit the bank details.

|

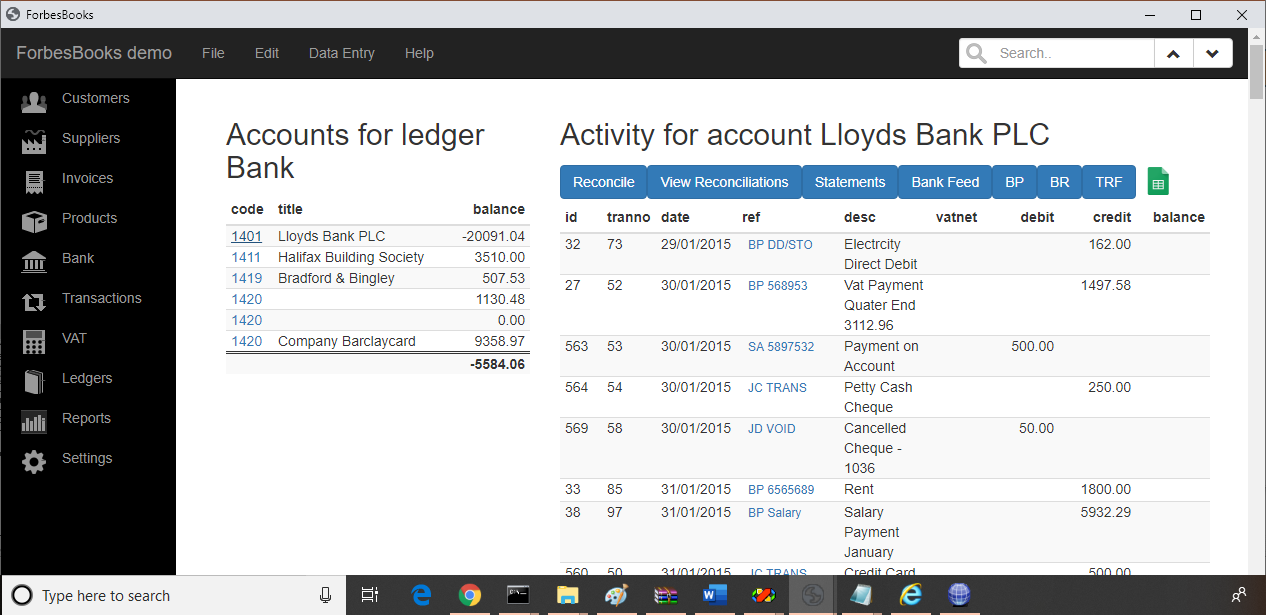

18.6.3 Bank ledger

To view bank transactions

|

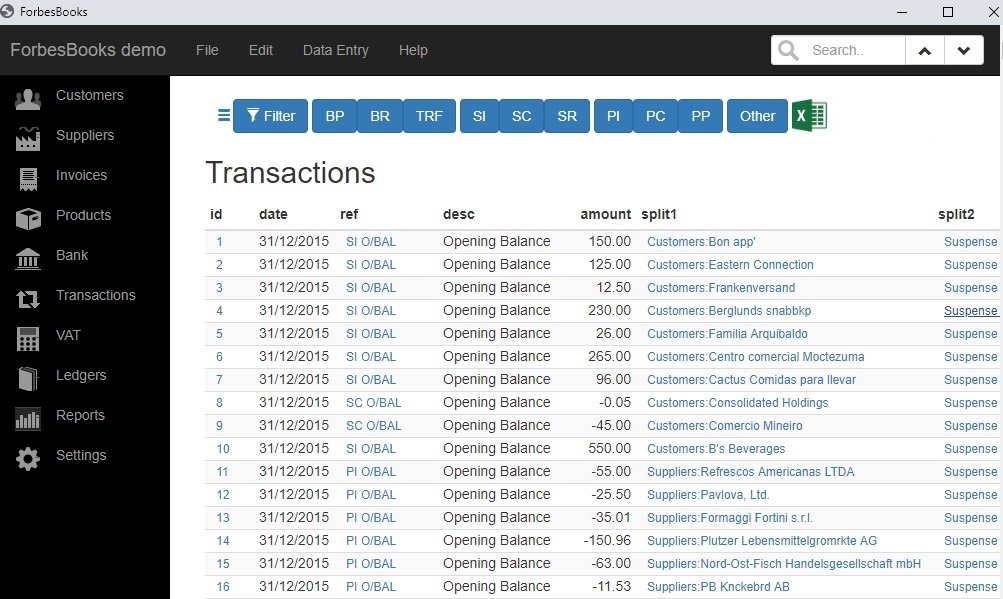

Click on the Transactions module.

|

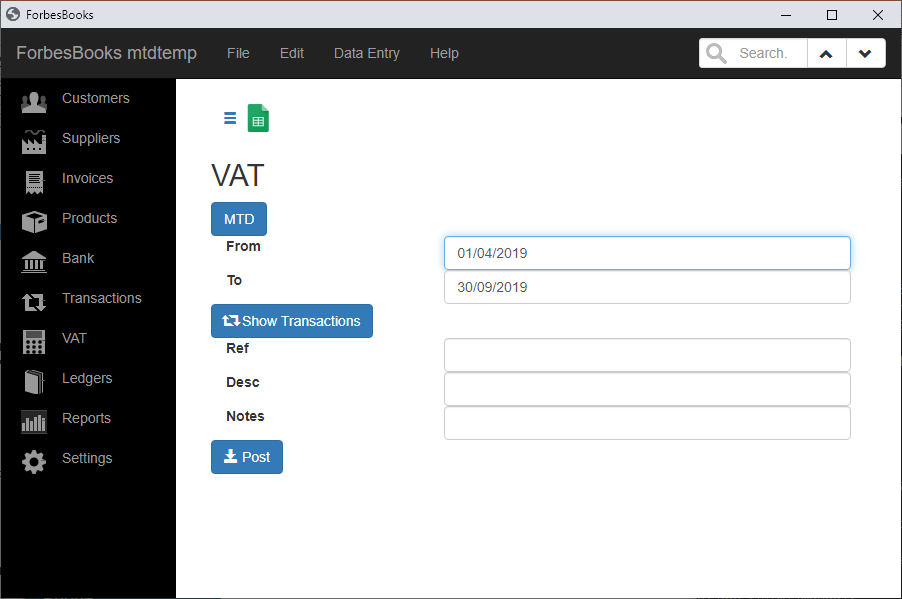

Click on the VAT module.

|

In settings/VAT you can set the vat periods so the dates come up automatically.

Fill in the from and to dates and press Show Transactions. This will list all the VAT transactions that have not been submitted on a return. Check these and if you are happy Fill in a Reference, Description and any notes. Leave desc blank and it will be generated.

Pressing Post will post this VAT return.

You can use the MTD button to submit this or any other previously generated VAT return

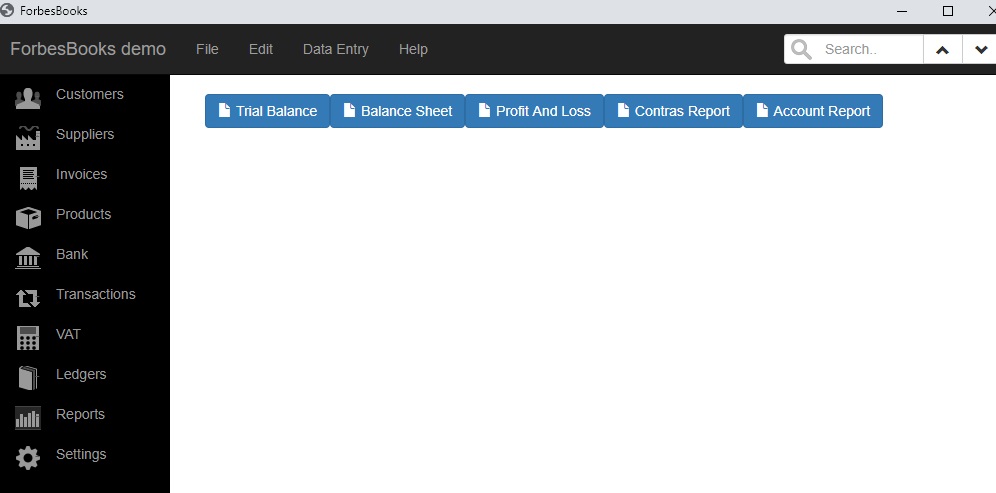

Click on the Reports module.

|

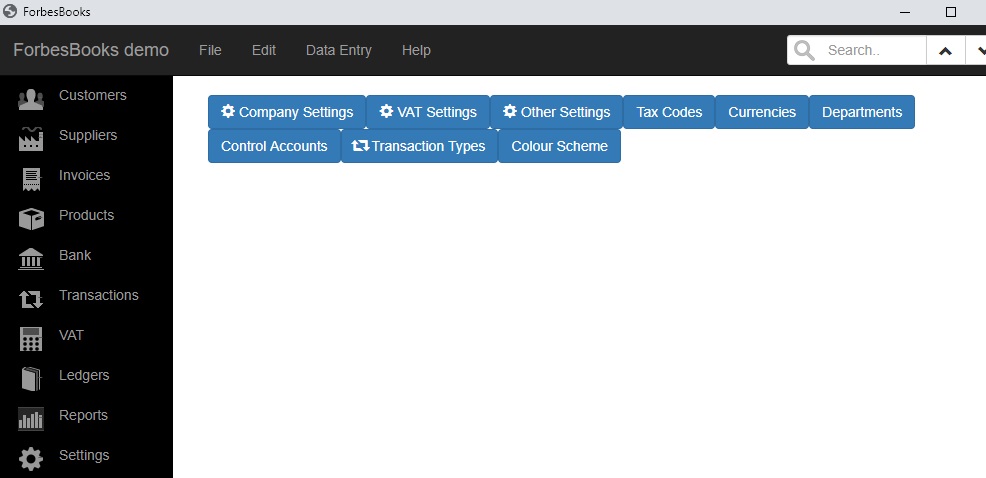

Click on the Settings module.

|

18.11.1 Company settings

18.11.2 VAT Settings

18.11.3 Other Settings

18.11.4 Tax codes

18.11.5 Currencies

18.11.6 Departments

18.11.7 Control accounts

18.11.8 Transaction Types

18.11.9 Colour Scheme

18.13.1 Introduction

Client access via the cloud works well from a number of devices including smart phones.

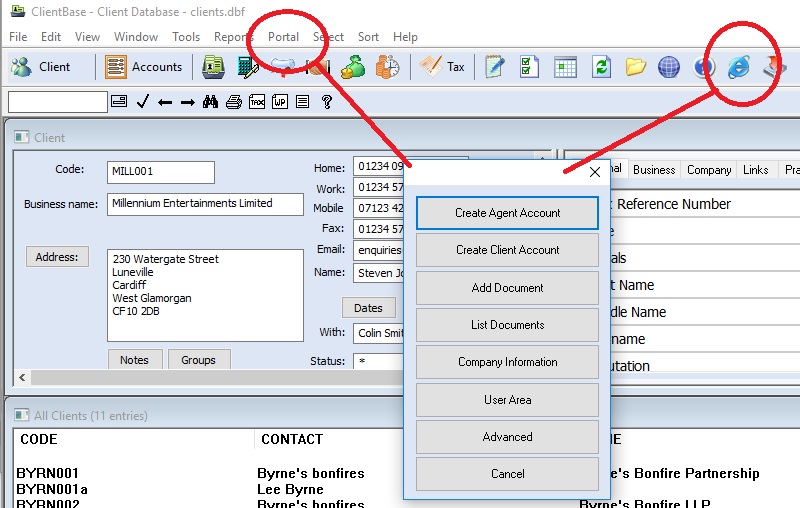

The client access to bookkeeping is via the portal. For more information about the portal see Chapter 13 section 13.18

The portal menu is available within all out software by clicking on the web icon or the sync icon on the launchbar or by choosing the Portal menu in clientbase.

|

18.13.2 Create Agent Account

If you have not already done so, use this option to create an account for your practice. You must set an email address under Tools / User setup / agent details before using this command. You will be asked for a password. You only need to do this once.

18.13.3 Create Client Account

If you have not already done so create a portal account for the client. It will use the email address in the client database and prompt you for a password. You must inform the client of the password and email address that they will use to log on

By default only document viewing is enabled. For the client to access bookkeeping you must go to the portal menu and choose advanced then client account properties. Say yes to bookkeeping.

18.13.4 Client Online Access

Clients can complete transactions via a simple interface at www.securefiler.co.uk.

18.13.5 Agent Online Access

Agents can also access the online version for their clients via a simple interface at www.securefiler.co.uk logging on with their agent account details.

You can upload your list of clients for online access by going into your client database program and choosing file / cloud / copy to cloud.

After logging in you should see a list of clients. Select the client and you will get a detail screen and you can go into bookkeeping.

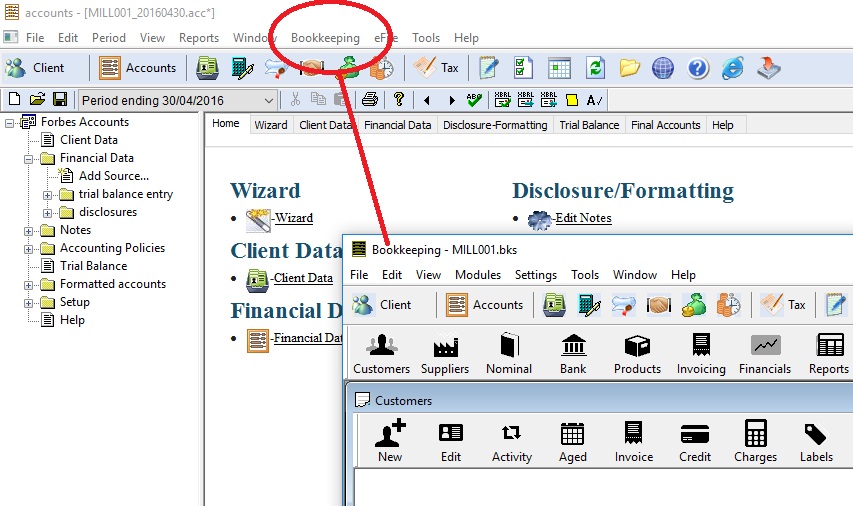

18.13.6 Agent Desktop Access

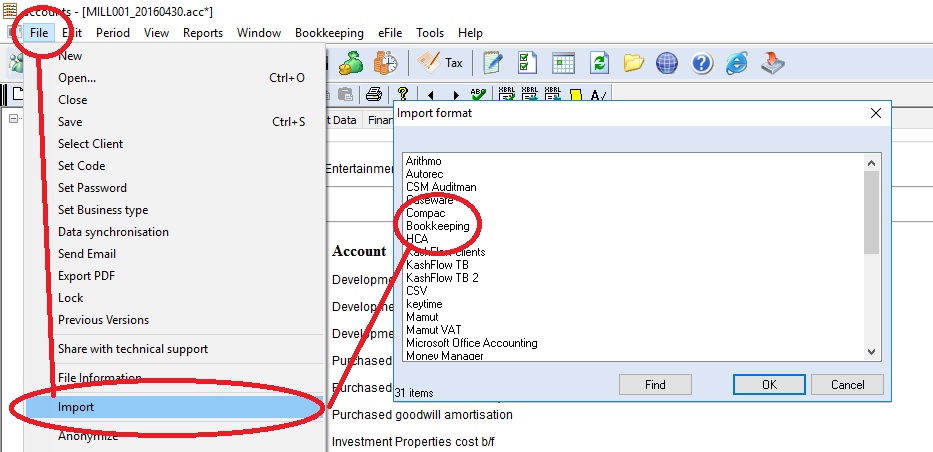

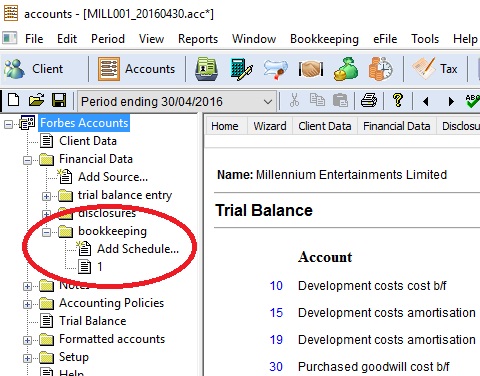

In order to produce final accounts and for various other purposes such as backing up, you can take a copy of the data on cloud and work in the desktop application.

The best way into the bookkeeping package on the desktop is to go into the accounts package and click on the bookkeeping menu.

|

You can take a snapshot of the online data by choosing File / Cloud / Copy From Cloud. This will take a copy to your local data.

The data entered in the simple online transactiosn will be in the income and expenses module - see below

If you make changes or you want to restore a backup you can choose File / Cloud / Copy to cloud.

Uploading a data set to the cloud will replace the data there - any transactions entered after the copy was made will be lost.